Choosing the 幸运飞行艇168体彩开奖官网直播-Tools for Boat Repairs

Having the right tool on hand can be the difference between making needed repairs to keep going instead of limping home.

Having the right tool on hand can be the difference between making needed repairs to keep going instead of limping home.

Powering your fishing adventures.

Shining brighter light on the best party on the water.

The RB100-HP’s battery management system is programmed to produce the bursts of high energy needed to start marine engines.

Learn how to install retractable transom tie-down straps and enhance convenience and safety when trailering your boat.

Advancements in electric motors raise new questions that boaters must answer when trying to make a power selection.

Join us in exploring fantastic deals on gear that delivers performance, reliability, and value.

Don’t stop enjoying nature when nature calls.

Though small, the Viaggio Lago V 16U definitely lives large on the water thanks to its decidedly upscale vibe.

The 292DLX Offshore combines amenities beloved by hardcore anglers with creature comforts that will keep the family happy.

The Parker Offshore 2900 CC fishes hard while incorporating the niceties that many buyers seek in a fishing boat.

The Bass Cat Jaguar STS is a premium, high-performance bass boat that offers tournament-ready fishing amenities.

The DC 306 combines great cruising manners with fishability.

Scout’s 357 LXF appeals to buyers who want a performance-flavored, ultra-finished, luxury approach in their center-console.

The Solara S-250 DC is versatile enough to handle everything from fishing trips to boating adventures and watersports.

The Checkmate Pulsare 2400 BRX looks great while pulling water toys and offering a good-size group a thrill ride.

The Zodiac Medline 7.5 GT is a rigid-hull inflatable that touches all of the bases while showcasing its style.

Advancements in electric motors raise new questions that boaters must answer when trying to make a power selection.

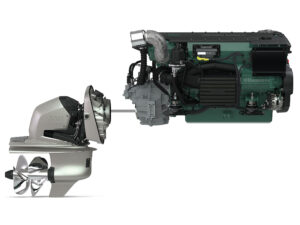

This 440 hp diesel Aquamatic sterndrive package represents an efficient and easy-handling alternative to outboards.

Boating readying to test new deckboat models from Bayliner, available as both sterndrive and outboard.

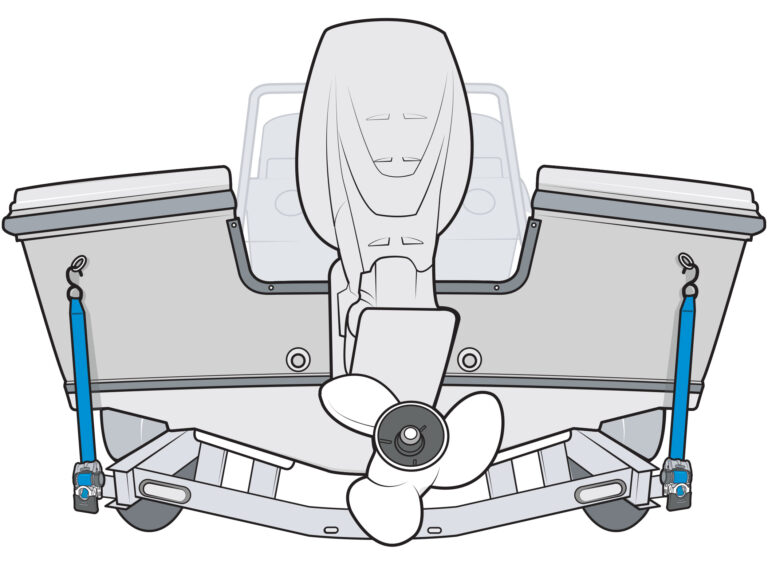

Here are some of the elements you should look for in a properly fitting boat trailer to prolong the life your hull.

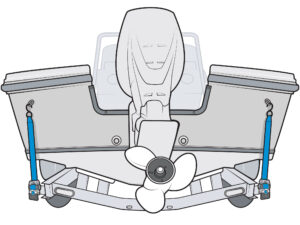

Learn how to install retractable transom tie-down straps and enhance convenience and safety when trailering your boat.

Choosing the right winch for your boat trailer hinges on a number of factors. Use these tips to narrow your selection.

Keep your boat looking great and improve safety with the best paint for non-slip surfaces.

Making these sterndrive maintenance checks will prolong the life of your engine and help ensure continued happy boating.

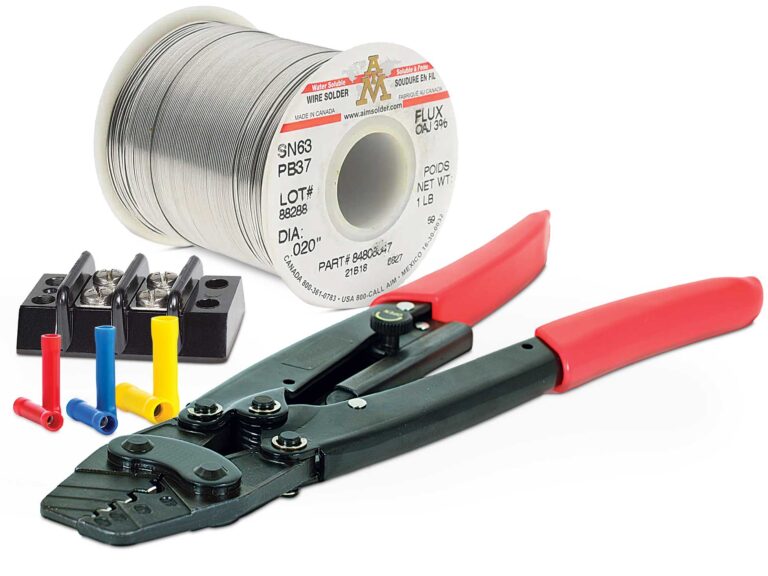

If you want to keep all of your boat’s electrical components safe, you’ll need to use the proper wire connections.

Four situations where you should give boaters with fishing lines in the water a wide berth to protect yourself and them.

Having the right tool on hand can be the difference between making needed repairs to keep going instead of limping home.

Powering your fishing adventures.

Shining brighter light on the best party on the water.

The RB100-HP’s battery management system is programmed to produce the bursts of high energy needed to start marine engines.

Join us in exploring fantastic deals on gear that delivers performance, reliability, and value.

Don’t stop enjoying nature when nature calls.

Many products 168网体彩飞艇官网实时直播号码+幸运飞行艇开奖官方网站历史走势精准计划、168新飞行艇官方查询信息号码+极速赛车记录官网查询结果 - 168极速赛车官方开奖 purchased through this site.

Copyright © 2024 幸运飞行艇开奖官方网站-历史结果查询记录-168新飞行艇官方查询信息号码 Boating. All rights reserved. Reproduction in whole or in part without permission is prohibited.